franklin county ohio sales tax on cars

The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance to which you may be entitled. Did South Dakota v.

Franklin County Raising Plate Fees

Franklin county ohio sales tax on cars.

. Your tax rate depends on your county of residence. Franklin OH is in Warren County. Franklin County OH Sales Tax Rate The current total local sales tax rate in Franklin County OH is 7500.

If you have questions contact the Ohio Attorney Generals Office at 800 282-0515 or 614 466-4320. Can I transfer a title for another person if they are unable to come to your office. 17TH FLOOR COLUMBUS OH 43215-6306.

Or visit our Ohio sales tax calculator to lookup local rates by zip code. The 2018 United States Supreme Court decision in South Dakota v. Franklin County in Ohio has a tax rate of 75 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Franklin County totaling 175.

However the average total tax rate in Ohio is 7223. Information can also be found online at www. All eligible tax lien certificates are bundled together and sold as part of a single portfolio.

Sales tax is required to be paid when you purchase a motor vehicle or watercraft. We accept cash check or credit card payments with a 3 fee. Wayfair Inc affect Ohio.

Please make checks payable to. Some dealerships may also charge a 199 dollar documentary service fee. The County sales tax rate is.

1500 title fee plus sales tax on. If you need access to a database of all Ohio local sales tax rates visit the sales tax data page. Franklin County OH Sales Tax Rate The current total local sales tax rate in Franklin County OH is 7500.

Franklin is in the following zip codes. Franklin County Ohio Sales Tax Rate 2022 Up to 775 The Franklin County Sales Tax is 125 A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax. The County assumes no responsibility for errors.

What is the sales tax rate in Franklin Ohio. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the entire delinquency. The current sales tax on car sales in Ohio is 575.

You may obtain county sales tax rates through the Ohio Department of Taxation. Franklin Countys is 75. 1500 title fee plus sales tax on.

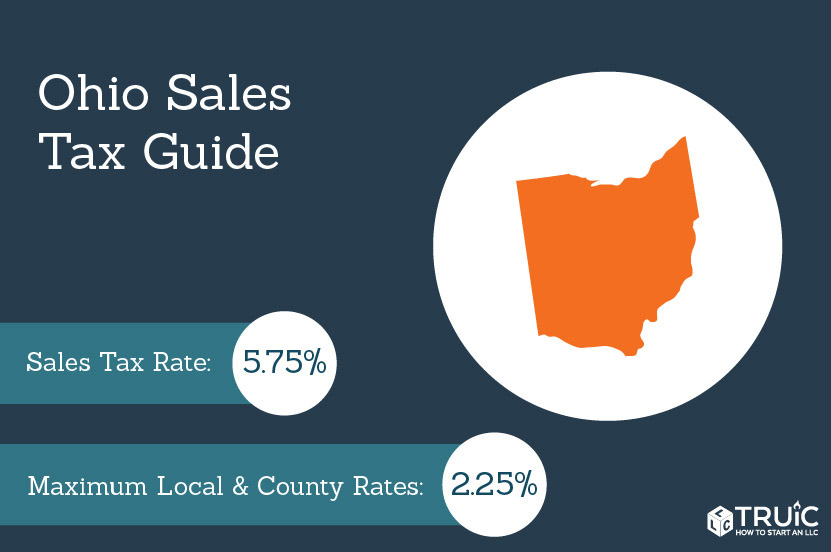

This rate includes any state county city and local sales taxes. You can find more tax rates and allowances for Franklin County and Ohio in the 2022 Ohio Tax Tables. Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

The December 2020 total local sales tax rate was also 7500. Its important to note this does not include any local or county sales tax which can go up to 225 for a total sales tax rate of 8. The Ohio state sales tax rate is currently.

Local tax rates in Ohio range from 0 to 225 making the sales tax range in Ohio 575 to 8. Franklin County Clerk of Courts. You may obtain county sales tax rates through the Ohio Department of Taxation.

Has impacted many state nexus laws and sales tax. The minimum combined 2022 sales tax rate for Franklin Ohio is. The Franklin sales tax rate is.

Auto repairs are regulated by Ohios Auto Repairs and Services Law. Overview of the Sale. The properties in community reinvestment areas in franklin county had an abated value of more than 42 billionwith about 111 million in taxes that werent collected under agreements with local.

Some cities and local governments in Franklin County collect additional local sales taxes which can be as high as 075. Franklin Countys is 75. This is the total of state county and city sales tax rates.

Depending on the nature of the business a career in auto repair may require various licenses and registrations. How to Calculate Ohio Sales Tax on a Car. The Franklin County sales tax rate is.

Taxes are due on a vehicle even when the vehicle is not in use. Please make checks payable to. This is the total of state and county sales tax rates.

In addition to taxes car purchases in Ohio may be subject to other fees like registration title and plate fees. 2020 rates included for use while preparing your income tax deduction. Franklin County Sales Tax Rates for 2022.

What county in Ohio has the lowest sales tax. How Much Is the Car Sales Tax in Ohio. Download all Ohio sales tax rates by zip code The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

US Sales Tax Rates. Wayfair Inc affect Ohio. HIGH ST 17TH FLOOR COLUMBUS OH 43215-6306.

Additional evidence may be required based on unique titling situations. The latest sales tax rate for Franklin OH. The Ohio sales tax rate is currently.

The base state sales tax rate in Ohio is 575. Our office is open Monday through Friday 800 am. There are also county taxes that can be as high as 2.

This is the total of state county and city sales tax rates. What is the sales tax on cars in Franklin County Ohio. 1500 title fee plus sales tax on purchase price add 100 fee per notarization andor 150 for out-of- state transfers.

2022 Ohio Sales Tax By County Ohio has 1424.

Vehicle Taxes Department Of Taxation

New Court Order Instructions Franklin County Ohio

Ohio Vehicle Sales Tax Fees Calculator Find The Best Car Price

Ohio Sales Tax Small Business Guide Truic

How To Save On Taxes When Buying And Selling A Car In Ohio Progressive Chevrolet

Out Of State Title With A Lien Or Lease Transfer Request

Columbus Man Dies In Guernsey County Motorcycle Crash Nbc4 Wcmh Tv

Ohio Tax Rates Things To Know Credit Karma

Auto Title Manual Franklin County Ohio

Ohio Car Registration Everything You Need To Know

Ohio Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vehicle Taxes Department Of Taxation

Car Sales Tax In Ohio Getjerry Com

Car Sales Tax In Ohio Getjerry Com

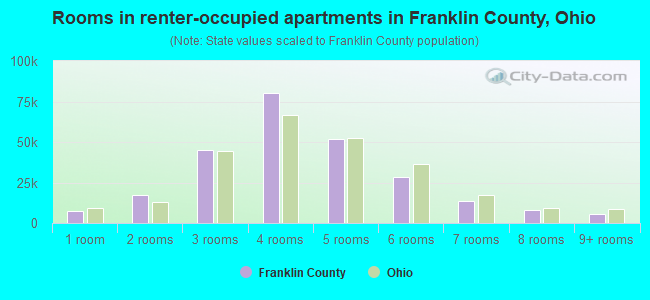

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More